Merger and Acquisition Law in India, Certificate Course

Introduction to Mergers & Acquisitions of Companies in India

Where could I do a certificate course in company Mergers and Acquisitions laws?

How a law course in mergers and acquisitions can help me?

- Providing you better chances in securing corporate jobs

- Dealing with corporate clients for their works pertaining to M & A

Career in Mergers and Acquisitions:

Ø Corporate Lawyer

Ø Counsel / Attorney

Closely Associated Professionals:

Ø CAs

Relevance of CAs and Lawyers regarding M & A

CAs and lawyers both are involved in M &

A to who the clients resort. While CAs are more concerned with accountancy,

lawyers are more concerned with court presentations.

What are corporate mergers?

Mergers

Merger is amalgamation of 2 or more business

entities which may have any business constitution like partnership, or company

such that the owners of the old entities are now owners of the newly formed

entity after the combination or amalgamation of the former entities. E.g.:

1. PVR

- INOX Merger

2. HDFC

LTD - HDFC BANK Merger

3. Microsoft

- Activision Blizzard

4. Moj

- MX TakaTak

What are the different types of company mergers?

Types of Mergers

q Vertical Merger: Involved parties / businesses involved in same type production but at

different stages. E.g. Merger between Zee Entertainment Enterprises Limited

Ltd. (ZEEL), a broadcaster, and Dish TV India Limited, a distribution platform

operator is an example of vertical merger where both the entities are at

different stages of the production / supply chain.

q Horizontal Merger: Parties

/ Businesses are in same line of business and may be competitors. E.g. Merger

of Vodafone India and Idea Cellular Limited, 2 telecommunication companies.

q Congeneric Merger: A merger

between two parties that are somehow related to each other with no mutual buyer

or supplier relationship. E.g. Merger between Thomas Cook India Limited and

Sterling Holiday Resorts (India) Limited is an example of a congeneric merger

as both the companies were involved in the tourism industry but their

customer-bases and process chains were unrelated.

q Conglomerate Merger:

Parties operate in different lines of businesses.

q Cash Mergers: A kind of merger where shareholders get cash instead of shares of the

merged entity.

q Forward Mergers: When an organization decides to merge with its buyers.

q Reverse Mergers: When an entity decided to merge with its suppliers of raw material.

q Market-extension merger

A market-extension merger is a merger between companies that sell the same

products or services but operate in different markets. The object of a

market-extension merger is to gain access to a larger market and thus ensure a larger

customer base. E.g. Merger between Mittal Steel and Arcelor Steel, a

Luxembourg-based steel company, is an instance of market-extension merger.

q Product-extension

merger

A product-extension merger is a merger between companies that sell related

products or services and operate in the same market. It is notable that the

products and services of the merging companies are not the same, but they are relevant.

E.g. This type of merger is not prominently visible in India. However, a

classic example of such merger is PepsiCo's merger with Pizza Hut. Both

companies worked in the same sector i.e., food and beverages industry, and sold

related but not the same products.

What are acquisitions?

Acquisitions

Under acquisition, a company acquires other

company or companies and the previous company is now known by the name of the

company which has acquired it.

The company which acquires is called acquiror and

the company that acquires is called acquiree. E.g.:

1. Elon

Musk - Twitter

2. Tata

Group - Air India

3. Adani

Group - NDTV

4. Zomato - Blinkit

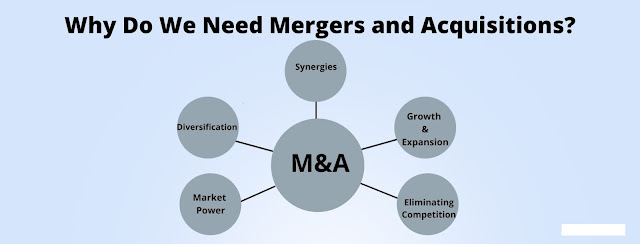

What are the purposes of Mergers and Acquisitions?

Objectives of M

& A

q Growth: Growth

obviously takes place due to any merger or acquisition due to increased

business of the uniting companies.

q Market

Exploitation: The resulting market can be exploited due to fewer operators who

may be in a position like monopoly.

q Acquiring

Specific Factors: There may be specific factors like skilled employees, patent

technologies, copyrights, etc. including goodwill of the merging companies or

the acquired company.

q Tax: M&A can sometimes lead to tax benefits if the target company is in a strategic industry or a country with a favorable tax regime. Further, acquiring a company with net tax losses enables the acquiring company to use the tax losses to lower its tax liability.

q Govt. Policies Compliance: Sometimes government policies may require merger mandatorily (e.g. Government imposing additional duty of certain types of companies and such company may acquire or merge with company which already carries out such duties and already possess a setup for it) or may be voluntarily to secure certain benefits (e.g. There may be a lower limit on turnover for applying for some governmental benefits and when entities get together may be in a position to create cumulative turnover to satisfy the requirement.)

q Diversification: To diversify into other field or segments of the same field requires a lot of factors of production to be accumulated which is time consuming and may create competition. This situation is easily overcome by merger or acquisition.

M & A vs Partnership

& JV

Stage: M & As can only be at a later stage while Partnership and JVs can

be since inception.

Ease: M & As are harder to carry out while Partnerships and JVs are much

easier to establish.

Joint ventures do not give rise to a fully distinct entity as JV is

only for a specific time period or for some specific purpose of the whole

entity and not all objectives of the entities forming JV. The entire entities

do not become one. So, in case where the entities do not wish to become 1 may

form a JV temporarily and who wish to become with a newer company existence may

resort to merger or acquisition.

#diplomainmergersandacquitions #diplomainmergerandacquition #diplomainMandA #lawcourseinMandA #certificationinmergerandacquition